Easy Merchant Cash Advance

Debt Relief Services

Business Reputation Pro

Trusted Partners

Struggling with Crushing MCA Payments?

You're Not Alone – And You Don't Have to Keep Paying 100% of What You Owe!

Professional MCA Debt Relief

Specializing In MCA Debt Renegotiation & Settlement

If your business owes $10,000+ in Merchant Cash Advances (MCAs), those daily/weekly withdrawals are likely draining your cash flow, stressing you out, and threatening your survival.

MCA Defaults Surge 59% To $2.2B

Our clients typically settle for 60-80% less than the full balance owed – often paying 20-40 cents on the dollar.

Stop The Bleeding Today

Calculate your potential savings in seconds and request a FREE, no-obligation consultation to plan your escape from crippling MCA debt.

MCA Debt Solutions Calculator

See How Much You Could Save – Free MCA Debt Calculator

Use the MCA Debt Reduction Calculator below and discover the savings you could expect from working with us to renegotiate and reduce your Merchant Cash Advance burden.

Protect Your Cashflow

You could reduce your MCA balance by up to 60 or even 80%

Affordable Payments

Save Your Business with a realistic escrow-funded settlement amount

Escrow Funded Relief

Learn How funding a simple escrow account replaces draining daily withdrawals

Personalized Strategy

This alternative beats bankruptcy, collections or endless high-factor payments

[MCA Relief Calculator Goes Here]

MCA Debt Solutions

The MCA Trap Is Real

But There's A Way Out

Merchant Cash Advances from funders, payment processors, or ISO brokers promised quick cash with "easy" terms – but the reality hits hard.

Sky-high debt servicing $$$

Your effective MCA payment costs are often 100-200%+ factor rates

Daily ACH Withdrawal Pains

MCA payments fluctuate and kill your cash flow often crippling business

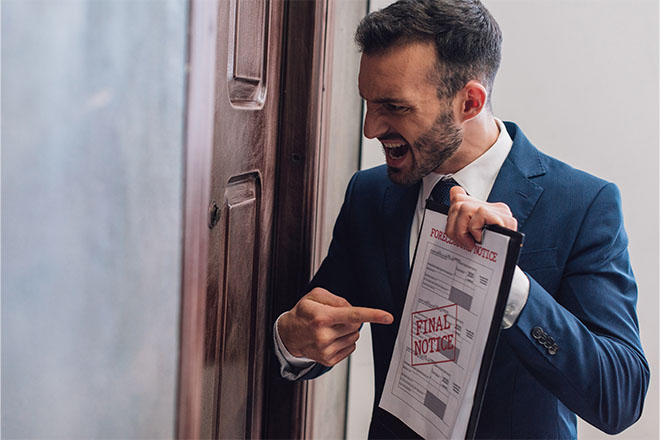

Lenders Are Aggressive

Vicious MCA collections, confessions of judgment, or threats of lawsuits

1500+

Satisfied Clients

100+

Certified Credit Experts

25K+

Negative Items Removed

300+

Educational Resources

Don't Live Another Day In Anxiety And Fear Over MCA Debt!

Request A Consultation Now

REQUEST MY MCA DEBT RELIEF CONSULTATION

Monday:

Credit Score Breakdown

Time:

7:00am - 8:00am

Credit Specialist:

Emily Johnson

Tuesday:

Credit Monitoring Setup

Time:

9:00am - 10:00am

Credit Specialist:

Michael Williams

Wednesday:

Dispute Strategy Session

Time:

10:00am - 11:00am

Credit Specialist:

Jessica Miller

Thursday:

Debt-to-Income Review

Time:

11:00am - 12:00am

Credit Specialist:

Emily Johnson

Friday:

Credit Report Analysis

Time:

1:00pm - 2:00pm

Credit Specialist:

Michael Williams

Saturday:

Financial Goal Planning

Time:

2:00pm - 3:00pm

Credit Specialist:

Jessica Miller

Four Simple Steps to MCA Relief

How Our MCA Debt Relief Process Works

Free Review

We analyze your MCA contracts, balances, and cash flow – consultation at no cost.

Stop Payments

Using proven negotiation strategies, we often get funders to pause withdrawals while we work.

Fund Settlement

Instead of feeding daily loan payments, you deposit affordable amounts into a secure escrow.

Negotiate & Settle

Funds accumulate toward lump-sum settlements, typically 60-80% overall reductions.

Results: Significant savings, no more daily stress, preserved operations – and a path back to stability without bankruptcy.

MCA Debt Relief Experts

Real Relief

Real Results

✅ Businesses with $50K+ in MCA debt have saved $20,000–$40,000+ on average

✅ Stop aggressive collections and protect your accounts

✅ Avoid bankruptcy's long-term damage to your credit and business future

✅ Regain control of your cash flow in weeks/months, not years

Ready to See Your Savings?

Take the First Step Now

Why Choose Us?

MCA Specialty

We focus exclusively on MCA debt relief, not general debt

Proven Results

Helping you settle for fractions of what you owe is all we do.

Transparency

No gimmicks, we staff a full legal team that works for you.

USA Based

Helping Businesses like yours is in all our best interests.

Common Questions

MCA Debt Relief FAQ:

Addressing Your Biggest Concerns

Why do so many MCA "relief" or settlement programs fail?

Many so-called MCA settlement companies promise big reductions but can't deliver because they have no legal or contractual authority to change your MCA agreements. They often tell you to stop payments to "force" a deal — which triggers defaults, frozen bank accounts, UCC liens, lawsuits, and even lenders going after your customers' payments. This creates more chaos than relief, and settlements rarely happen.

Our approach is different: We use proven negotiation tactics with direct experience in MCA structures to secure real settlements (typically 60-80% off the balance, or 20-40 cents on the dollar) without advising reckless payment stops that expose you to immediate legal risk.

If I stop payments to negotiate, won't the funders just sue me or seize my accounts?

Yes — that's exactly what happens in most DIY or low-end settlement attempts. Stopping ACH withdrawals is a default trigger under almost every MCA contract, leading to rapid escalation: collections, confessions of judgment enforced, bank freezes, and legal action within weeks.

We strategically pause or redirect payments in many cases through negotiation leverage (showing inability to pay full amount long-term), while building your escrow fund safely. This protects your business from aggressive tactics during the process, and most clients see settlements completed without court involvement.

Can a third party really force an MCA funder to settle for less?

Unscrupulous settlement firms can't "force" anything because they're not part of your contract. Many take upfront fees and disappear when funders refuse to budge.

We succeed because we specialize exclusively in MCAs, understand funder behavior (they often prefer a negotiated lump sum over chasing a failing business through costly litigation), and only get paid when you save. Our track record shows funders frequently accept 60-80% reductions when presented with realistic alternatives like prolonged defaults or bankruptcy.

Isn't this just like those risky settlement companies that tell you to stop paying?

No. We don't rely on blind payment stops or gimmicks. Our process involves:

- Thorough review of your contracts and situation

- Professional negotiation to halt or reduce aggressive collections

- You funding a secure third-party escrow account (instead of daily drains)

- Lump-sum settlements once funds accumulate

This structured, transparent method minimizes risk while maximizing savings — and avoids the "financial quicksand" of stacking more debt or defaulting outright.

What if I have multiple stacked MCAs? Will this still work?

Yes — we specialize in multi-MCA cases (the most common scenario we see). Stacking more advances is one of the worst things you can do, as it spirals payments higher. Our settlement strategy handles multiple funders simultaneously, often achieving the biggest percentage reductions on stacked debt by demonstrating the full unsustainable picture.

Will settling my MCA debt hurt my business credit or make future funding impossible?

Settlements can appear on business credit reports as "settled for less," which is better than ongoing defaults, charge-offs, or bankruptcy (which devastates credit for 7-10 years). Many clients rebuild and access better funding after relief because their cash flow stabilizes. We guide you on credit impact and post-settlement strategies.

How is your process different from bankruptcy or just toughing it out?

Bankruptcy is a last resort with long-term damage to personal/business credit, potential asset loss, and years of scrutiny. "Toughing it out" often leads to collapse under daily withdrawals.

Our escrow-based settlement lets you keep operating, regain cash flow control quickly, and resolve debt for a fraction of the balance — typically in 3-6 months — without the nuclear option of bankruptcy.

Are there any upfront fees?

No upfront fees. Only a simplified payment restructuring typically made weekly to the escrow account as opposed to daily MCA payments.

How do I know this will work for my business in 2025/2026?

MCA landscape is tougher than ever — higher defaults, aggressive collections — but that makes funders more open to realistic settlements to avoid zero recovery.

Use our free MCA Debt Reduction Calculator right on this page to see personalized savings estimates based on your balance and payments. Then book a free, no-obligation consultation — we'll review your exact situation and tell you honestly if we can help (and how much).

Ready to see your potential savings and stop the MCA stress? Request Free Consultation

I never thought rebuilding credit could be this smooth. The team walked me through every step and delivered results faster than expected.

Jen Selter

Client

In just a few months, I went from being denied credit cards to receiving multiple approvals. Their expert guidance truly made all the difference.

Michelle Lewin

Client